Your cart is currently empty!

2020 Cashew Prices On The Rise

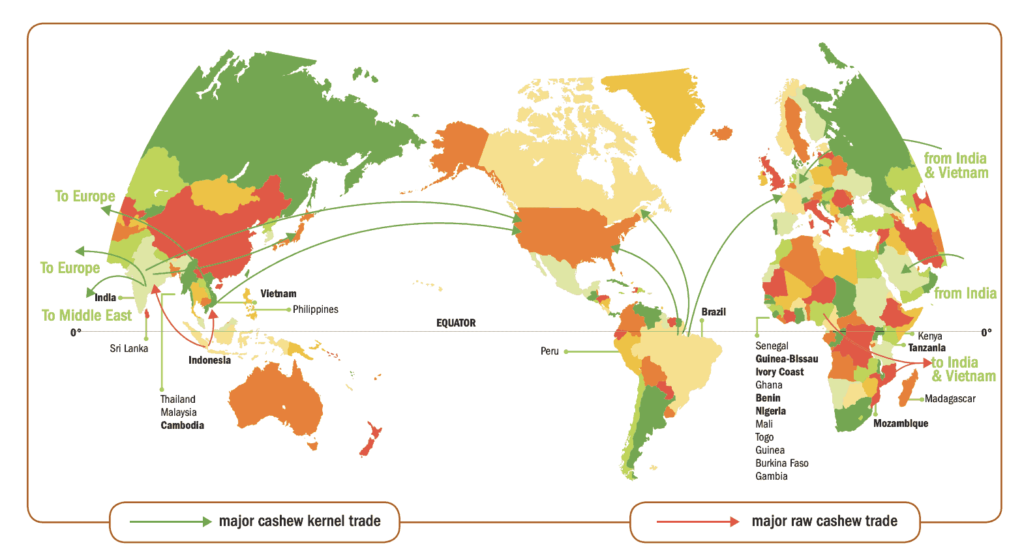

Globally, India makes up 40% of the cashew market and Vietnam is 33% of the market. But, Vietnam is the number one supplier of cashew kernel to America. If you are in America then you are more than twice as likely to eat a Vietnamese cashew than an Indian cashew.

According to the Vietnam Cashew Association, supplies for overall export were down 46%. The Vietnam Cashew Association shared that even with the cross-border trade with countries, like Cambodia, Vietnam could not hit the 2017 targets. It is reported in the Vietnam English Language News that as of June 2018, only 80% of cashew processors are working currently. The remaining processors are on a halt due to a severe lack of raw materials.

Vietnamese firms 2018 increased processing capacity by 25% over the same period last year. The market has been flooded with a large volume of cashew products. Thus, American traders had been able to force the Vietnamese to sell at lower prices. Leading to a dip in the price of cashews. But not for long. Wholesale cashew prices will be on the rise all year.

Even with this drop in production, Vietnam is still the leader in American cashew supply. Followed by Nigeria and India. Brazil comes in at number four. Because the harvest seasons of the major cashew-producing countries are intertwined, one poor harvest can significantly damage the global trade equilibrium of the entire season.

A Recent History Of Cashew Prices

In the 2016 and 2017 harvest seasons, global cashew production was reported to be 30% to 40% lower than the high in 2015. 2015 was the highest for cashew production worldwide. So, suppliers built facilities. Leading to 25% in processing production last year.

A huge factor that has altered global exports of cashews is domestic usage. Domestic demand in India had spiked. India had lowered their export numbers based on the homegrown growth in demand.

From the high in 2015, prices were low and the supply was high. A poor crop season from 2016 to 2017 resulted in a price spike. The price rose from the $3.55 to $3.70 range to the $5.00 to $5.10 range That is a 35% rise.

2020 Changes in the Cashew Market. What to Expect.

Offsetting the internal demand for cashews domestically in India are other countries ramping up production. For many years, African nations suffered from a lack of infrastructure. Bulk raw cashews were exported at a low price from Africa. The West African local farmers were unable to make sufficient income from cashew compared to the big processing countries of India and Vietnam. Currently, West African governments are building regional cashew processing facilities and infrastructure to stop getting a better price and sell more products. Vietnam and India had previously relied heavily on West African countries like Ghana and Nigeria, for raw cashew nut supplies. (Get the full History of the Cashew Economy throughout Africa here.)

West Africa’s movement toward implementing bigger and more modernized cashew processors will make a significant change. This will help stabilize the global cashew price. But these changes will take years to implement. So, for 2020, cashew prices will continue to rise.