Your cart is currently empty!

Behind The Increase In Nut Pricing | With Aiden Wright Of Mintec

Aiden Wright is a Pricing Analyst for Mintec. They perform pricing and industry analysis. They say, “Through our data and online analytics tools, we deliver visibility on the coming increase in nut pricing, improved budget management, & greater spend control to the world’s largest brands.” This article will only look at a small number of products they analyze. Specifically the nut industry, including peanuts, almonds, and cashews.

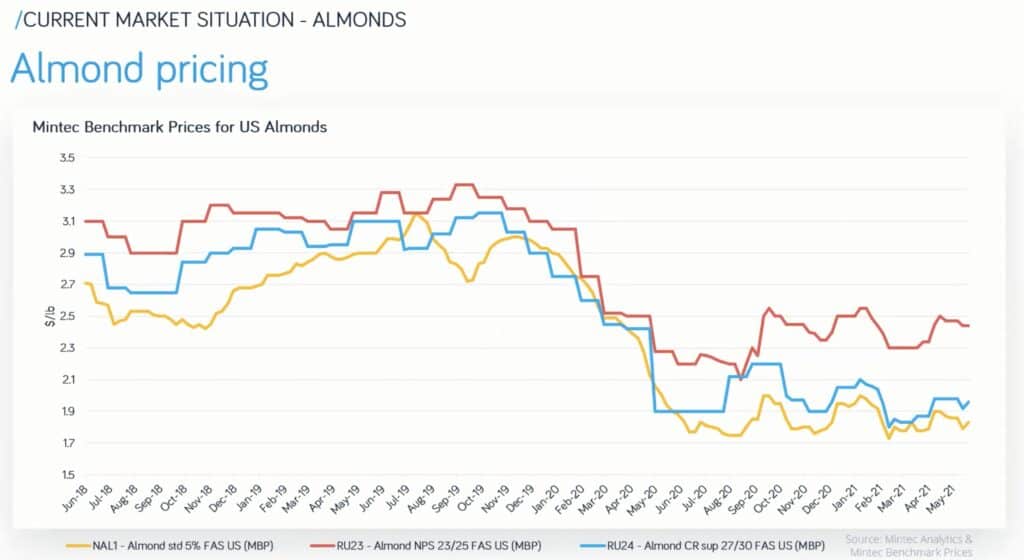

Historical Almond Pricing | 2018 – 2021

The yellow line is called the Baseline Industrial Grade. The yellow line is always going to be the lowest price. That is the underpinning price that moves the market. You can see a substantial decline. In terms of benefits, almonds have seen record shipments coming through. We have seen prices decline since just before the start of the Covid pandemic. The other lines look at varying grades of almonds. So, you’ll see the smaller size, 27 -30’s, or the blue line, having shifted down. While there has been only a slight shift downward for 23-25, or the red line, which is more giant almonds. You can see the difference between the 23-25 and the 27-30 widening significantly over the coming months of 2023.

Despite being the largest crop in history, the larger kernel size remained more expensive than the small kernels. When the almond trees are bearing, increased yield in terms of the number of nuts will impact the kernel sizes. We will eventually see some of those prices decrease on larger sizes. The average sizes are usually the larger 23-25, but now we will see smaller sizes, 25-27 and 27-30, on the market going forward.

Almond Demand for 2022 And 2023

Demand has been excellent. We had record shipments for this point in the season. Up 20% and almost every single month except January. There is a need for these record shipments while the crop continues to grow. Looking like a crop of 3 billion pounds to move. It has never been seen this size before.

The sales are going to price-sensitive markets. They are India and China. India has seen a 57% uplift. China has seen a 67% uplift. You usually wouldn’t see this increase in nut pricing if the prices were higher. That is really what needs to come across here. A lot of this demand is driven by low pricing. The expectation from the market is that this trend is going to continue. Everyone’s expecting record shipments. 650 tons would still put us at a significant size of exporting America to India and China.

Three Trends In Almond Supply

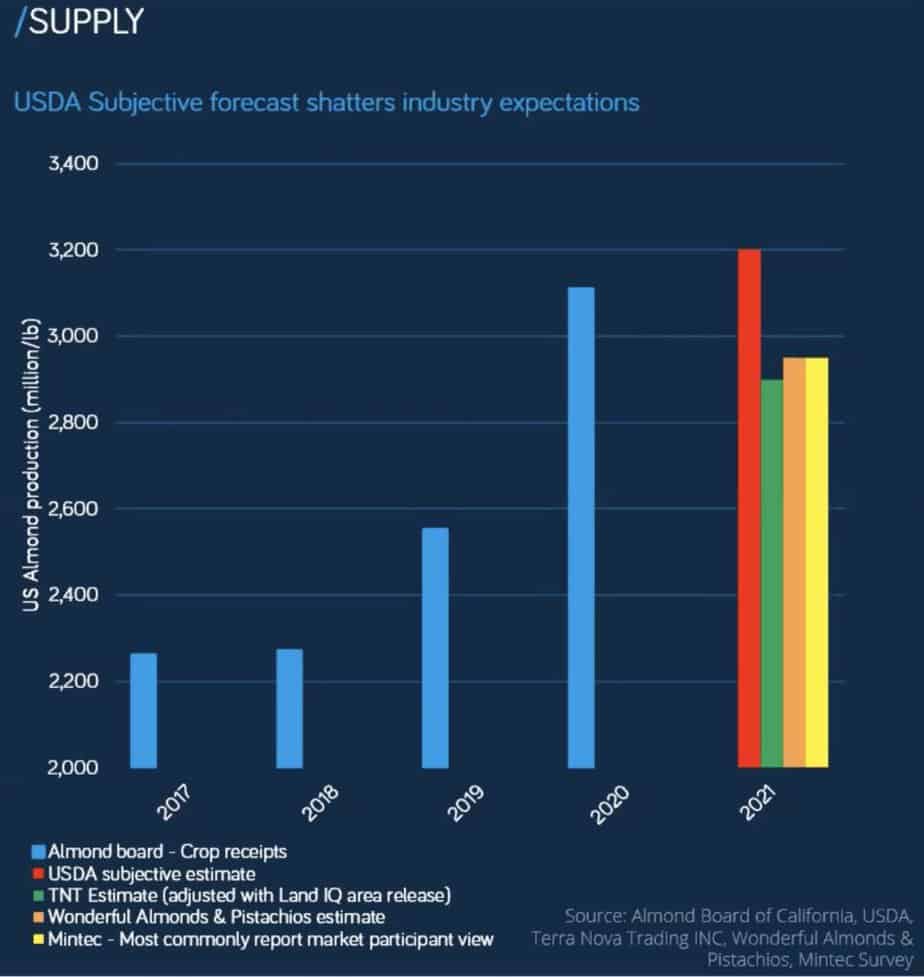

From his work at Mintec, Aiden Wright is expecting around 2.5 billion pounds of almonds, which is lower than the 3.2 figure that the USDA expects. Customers still aren’t entirely buying into this USDA figure. California is in the middle of an intense drought. This is why buyers are working to firm up almond prices now because they see that the USDA estimates look towards a noticeable increase in nut pricing. The Growers, at the same time, still see an upcoming surplus. Since India and China are absorbing this crop, they want to get in now with the lower prices.

Growers in America believe that all these factors lead to higher almond prices. They want to wait. They want those phones to ring a little longer before committing to costs. The Growers hold onto their surpluses as long as possible before committing to selling prices. Customers want this crop to move out of California at the current prices, but they find that difficult.

Historical Cashew Pricing | 2015 – 2021

Cashew pricing was hit quite hard by the pandemic. Unlike the almonds business. Pricing is currently up, well above the price from the start of the pandemic lockdown in March 2020.

You can see from the graph above that there was a split between the whole cashews and the pieces of cashews. The pandemic made this difference even wider. The industrial or bits and pieces market took a heavy fall in price. This was a 10-year-low for all cashew products. This dip has everything to do with the loss of industrial demand. Think about this. Cashews have taken over pine nuts in pesto recipes due to price. The pandemic took down all that cashew pesto being made in restaurants overnight.

Manufacturers have all reopened. Helping raise prices with the Spring and Summer of 2022. Aiden Wright sees that the cashew prices have stabilized and will stay at this level for cashew wholes and pieces. Vietnam is the second largest supplier of cashews in the world. They offered some discounts to help drive sales of their product. Getting some of that lost pandemic cash flow back into the South Asian market.